Marketrocks Review: Enhancing Your Trading Journey

Selecting the right broker is pivotal for any trader, shaping their path to success. Marketrocks emerges as a formidable contender in the online trading arena, presenting a wide array of services tailored to enrich the trading experience for both novices and seasoned traders alike. This comprehensive Marketrocks review delves into its distinctive offerings, security measures, account structures, and trading platforms, furnishing traders with invaluable insights to facilitate well-informed decisions.

Visit Marketrocks.com for more details.

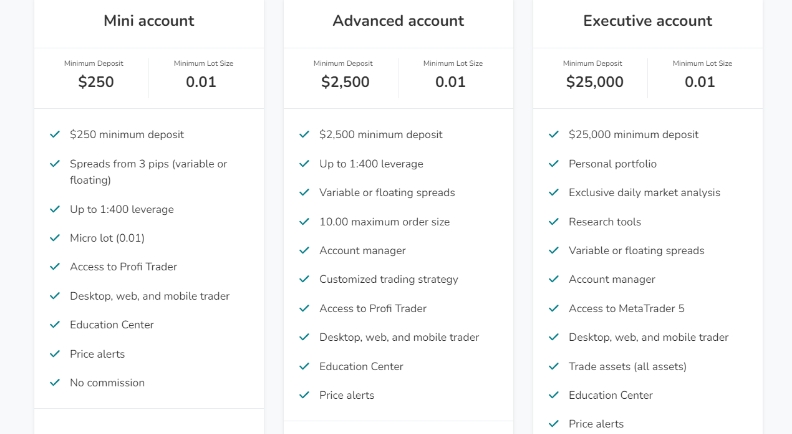

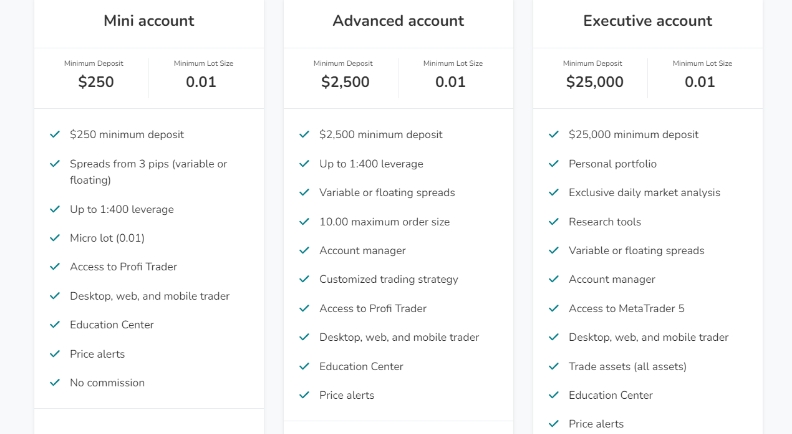

Marketrocks sets itself apart with its versatile offerings catering to a diverse audience. With a minimum deposit of $250, it facilitates entry into the trading realm for beginners while offering scalable options for experienced traders through various account tiers. Boasting an extensive asset portfolio encompassing over 2000 trading instruments across forex, commodities, indices, and cryptocurrencies, Marketrocks ensures traders have abundant opportunities to diversify their investment strategies.

A noteworthy feature highlighted in this Marketrocks review is its micro lot trading starting from 0.01 lots, enabling users to trade smaller amounts and manage risks effectively. Advanced traders benefit from leverage of up to 1:400, amplifying their trading prowess. With an impressive execution speed of 0.02 seconds, Marketrocks minimizes slippage, ensuring orders are executed at optimal prices.

MarketRocks’ commitment to inclusivity is evident through its provision of Islamic accounts, fostering a welcoming environment for traders of diverse backgrounds. This approach not only expands the broker’s reach but also underscores its dedication to accommodating the needs of its diverse clientele.

The broker differentiates itself with a versatile offering that caters to a wide audience. Starting with a minimum deposit of $250, it makes entry into the trading world accessible for beginners, while providing scalable options for seasoned traders through various account tiers. The platform’s asset portfolio is extensive, featuring over 2000 trading instruments across forex, commodities, indices, and cryptocurrencies, ensuring traders have ample opportunities to diversify their investment strategies.

The feature we want to emphasize in this part of our Marketrocks review is the micro lot trading from 0.01 lots, which allows users to trade smaller amounts and manage risk effectively. Advanced traders will appreciate the leverage up to 1:400, enhancing their trading power. The execution speed of 0.02 seconds is impressive, minimizing slippage and ensuring orders are executed at the best possible prices.

MarketRocks’ commitment to inclusivity is evident through its provision of Islamic accounts, making it a welcoming platform for traders of diverse backgrounds. This approach not only broadens the broker’s reach but also underscores its dedication to accommodating the needs of its diverse clientele.

Is it Safe to Invest With Marketrocks?

Security and regulation are paramount in the online trading realm. Marketrocks, operated by Gold Coast Advisors Ltd and based in Saint Lucia, demonstrates its commitment to high regulatory standards and robust security measures. Implementation of advanced security protocols, including encryption, two-factor authentication, and a comprehensive KYC process, safeguards traders’ information and funds effectively. Additionally, adherence to AML and CTF policies fortifies its stance on security, offering traders peace of mind.

Additionally vital for our Marketrocks review, its adherence to AML and CTF policies further solidifies its stance on security, offering traders peace of mind. However, the geographic restrictions, including the unavailability of services to residents of certain countries, highlight the broker’s compliance with international regulatory standards, which, while limiting access for some, underscores the broker’s commitment to lawful operations.

Marketrocks Accounts:

Tailored for Your Needs

Marketrocks’ tiered and deposit-based account structure is strategically designed to enhance the trader experience by catering to diverse needs and preferences. This structure presents a clear pathway for traders of all levels, from novices to professionals, ensuring each trader finds an account aligned with their trading style and financial capabilities.

Commencing with the “Beginner” account, traders encounter a low-entry barrier, fostering accessibility for newcomers to start trading without significant financial commitments. As traders progress, upgrading to higher-tier accounts unlocks additional benefits such as lower spreads, higher leverage, access to expert advisors, and personalized account management. Seasoned traders immediately access accounts equipped with advanced tools and higher leverage, facilitating the implementation of sophisticated trading strategies.

Let’s start our marketrocks.com review with something for newer traders. This structure offers a low-entry barrier with the “Beginner” account, requiring a modest minimum deposit. This accessibility encourages those new to trading to start without a significant financial commitment, allowing them to gradually build their confidence and understanding of the markets.

As these traders gain experience and wish to access more advanced features and services, the tiered structure provides a clear path for progression. Upgrading to higher-tier accounts unlocks additional benefits such as lower spreads, higher leverage, access to expert advisors, and personalized account management. This system rewards traders for their loyalty and growth, offering tangible benefits as they move up the tiers.

We also need to cover the upside for experienced traders in this part of our Marketrocks broker review. They can immediately access accounts that offer the advanced tools and higher levels of leverage they require to implement their sophisticated trading strategies. Additionally, the VIP and professional accounts offer bespoke services, including personalized trading advice and access to exclusive market insights, further enhancing the trading experience for high-volume traders.

This tiered account system not only suits the needs of both new and experienced traders but also creates a dynamic trading environment where users are encouraged to develop their skills and expand their trading activities. In the next part of our Marketrocks review, we present the exact account specifications.

Account specifications at marketrocks.com

Beginner

- Minimum Deposit: 250 USD

- Basic market access

- Mobile trading

- No extra fees

- One click trading

- Daily Analysis

Standard

- Minimum Deposit: 5,000 USD

- Basic market access

- Swap free/islamic

- No extra fees

- One click trading

- Daily Analysis

Intermediate

- Minimum Deposit: 5,000 USD

- Basic market access

- Market coverage

- Swap free/islamic

- No extra fees

- Daily Analysis

Advanced

- Minimum Deposit: 50,000 USD

- Basic market access

- Personal account manager

- Swap free/islamic

- Market coverage

- Daily Analysis

Integral

- Minimum Deposit: 100,000 USD

- Full Market Access

- Personal account manager

- Special Market Coverage

- Market coverage

- Trading strategies allowed

VIP

- Custom market access

- VIP personal manager

- Special event invitations

- Private instant support

- Trading strategies allowed

Marketrocks Platform:

Empowering Your Trading Experience

Engineered to deliver a seamless and efficient trading experience, Marketrocks’ trading platform significantly contributes to traders’ potential success. Real-time pricing, high leverage options up to 1:400, and one-click trading enhance trading convenience and efficiency. With over 30 charting indicators and multiple order types, traders can conduct thorough market analyses and develop informed trading strategies effectively. Cross-device compatibility, including dedicated applications for Web, iOS, and Android devices, ensures traders can access their accounts and the markets anytime, anywhere.

The next important detail for our Marketrocks review is the platform’s cross-device compatibility, including dedicated applications for Web, iOS, and Android devices, ensures that traders can access their accounts and the markets anytime, anywhere. This ubiquitous access is crucial in today’s fast-paced financial markets, enabling traders to stay connected and make timely decisions, regardless of their location.

By integrating these advanced features into its trading platform, Marketrocks not only makes the trading experience more convenient but also enhances the traders’ ability to achieve success. The platform’s design focuses on providing traders with the tools and functionalities they need to navigate the markets effectively, adapt their strategies to changing market conditions, and ultimately improve their trading performance.

Conclusion

In conclusion, Marketrocks stands out as a broker committed to providing a secure, inclusive, and comprehensive trading environment. While geographic limitations may restrict access for some potential clients, Marketrocks invites traders to explore its platform, promising a blend of versatility, security, and opportunity in the financial markets. With a focus on enhancing customer experience through diverse offerings and supportive account structures, Marketrocks is poised to meet the evolving needs of the global trading community.

While geographic limitations may restrict access for some potential clients, the overall proposition of MarketRocks invites traders to explore its platform, promising a blend of versatility, security, and opportunity in the financial markets. With a focus on enhancing customer experience through its diverse offerings and supportive account structures, MarketRocks is well-positioned to meet the evolving needs of the global trading community.